Report: DDR5 RDIMM Production Impacted by PMIC Compatibility Issues

by Anton Shilov on April 26, 2023 2:00 PM EST- Posted in

- Memory

- Samsung

- Micron

- SK Hynix

- DDR5

- EPYC

- Xeon Scalable

- Sapphire Rapids

Memory module producers have been shipping unbuffered DDR5 memory modules for desktop and laptop computers running Intel's 12th Generation Core 'Alder Lake' processors in high volumes since September, 2021, without any major issues. But DDR5 is just now entering the datacenter world, and according to a recent report, it looks like power management ICs (PMICs) for registered DIMMs have become a constraining factor due to compatibility issues.

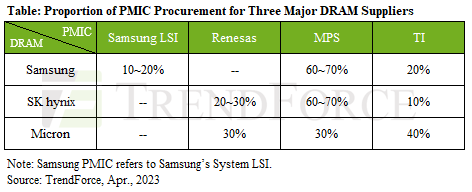

In a report published by TrendForce discussing the current state of the market for server-grade DDR5 memory, the semiconductor analyst firm noted that there is an issue with PMIC compatibility for DDR5 RDIMMs, with both DRAM suppliers and PMIC vendors are collaborating to resolve the problem. The analysts do not reveal the exact root cause of the problem, but claim that PMICs from Monolithic Power Systems (MPS) do not have any issues, leading them to expect MPS PMICs to be in high demand for the foreseeable future.

Although DRAM makers have been distributing samples of their server grade modules to CPU and server makers since early 2022, practical issues only emerged recently when producers began to ramp up production of their machines running AMD's EPYC 9004 'Genoa' and Intel's 4th Generation Xeon Scalable 'Sapphire Rapids' processors. As a result, the demand for PMICs from a single supplier has created a bottleneck in production, claims TrendForce. This will have a knock-on effect on the server market, which is already suffering from a demand drop.

Neither analysts nor DRAM producers are currently disclosing the precise reason for the PMIC issue. But it is evident that, as both client and server DDR5 DIMMs require PMICs, it is turning out to be harder to make server-grade modules than client-aimed DIMMs.

As part of the changes that came with the DDR5 specification, DDR5 memory modules now come with their own voltage regulating modules (VRMs) and PMIC. Moving these components on to DIMMs is intended to minimize voltage fluctuation ranges (DDR5's allowable range is about 3% (±0.033V) for a 1.1 volt supply), as well as decrease power consumption and improve performance. But doing so adds complexity to individual DIMMs, as well.

Unbuffered DDR5 DIMMs for client PCs are relatively simple since they are all single or dual-rank and carry at most 16 single-die memory chips. High-capacity Registered DDR5 memory modules for servers use more chips and those chips can pack in multiple DRAM dies each, which greatly increases complexity.

As a result of the PMIC bottleneck as well as a slower ramping of DDR5 manufacturing capacity, TrendForce predicts that prices of server-grade 32GB DDR5 modules will drop to around $80 - $90 in April and May, due to the lower fulfillment rates of DDR5 server DRAM in the short term. As a result, DDR5 prices are expected to fall more slowly than DDR4 for the next couple of quarters, with DDR5 prices only finally catching up (or rather, down) with DDR4 once production picks up.

Source: TrendForce

3 Comments

View All Comments

dwillmore - Thursday, April 27, 2023 - link

How did three DRAM and four (three) PMIC vendors all manage to forget to communicate with each other for over a year? Forecasting demand and communicating that to your parts supplier (and managing contracts with them) is a basic part of produrement management. Did all of these companies collectively mess this up? This isn't a single point of failure, it's many people completely forgetting to do their jobs.deil - Thursday, April 27, 2023 - link

I hope this will be good motivation to finally get some high capacity dims out. I know getting dram right is way harder, but we are so behind on that part, its ludicrous.dwillmore - Thursday, April 27, 2023 - link

Talk about looking for the silver lining! ;) "Can't produce a lot of DIMMS because of a lack of parts? Better just make high capacity ones!"