NUVIA Completes Series B Funding Round: $240M

by Dr. Ian Cutress on September 24, 2020 9:30 AM EST- Posted in

- CPUs

- Enterprise

- SoCs

- Enterprise CPUs

- NUVIA

- Series B

- Funding

One of the more interesting startups of late is NUVIA, with promises of a new Arm-based processor for the datacenter to rival the x86 dominance of AMD and Intel. The team at NUVIA is strong, comprised of top SoC architects from Apple and Google, with a long history of success within the ranks of the company. Building a leading-edge SoC takes a long time, and so we’re still not expecting NUVIA to offer a product for a while yet, but in that time the company is going through rounds of investment in order to both build the company as well as accelerate R&D before the first set of products are launched. Today NUVIA is announcing that the second round of funding, originally scheduled at for the beginning of the year, has been completed.

Series A funding was announced on November 15th, 2019, and raised $53M. Lead investors include WRVI Capital, the Mayfield Fund, Dell, Capricorn Investment Group, and participation from Nepenthe LLC, two the final two acting as investor partners. NUVIA currently resides on a floor in one of Dell’s unused corporate buildings in the Bay Area, for example.

Series B funding is being announced today, and has raised $240M. The funding round was led by Mithril Capital in partnership with former founders of Marvell, as well as Blackrock, Fidelity Management & Research LLC, and Temasek, with additional participation from Atlantic Bridge, Redline Capital and the previous members from Series A.

This brings the total raised to $293M. No further information was detailed in NUVIA’s press release.

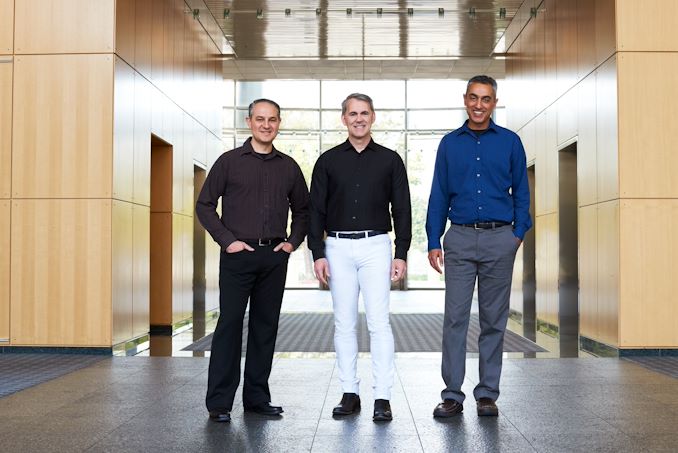

Key figures at NUVIA include the three founders: Gerard Williams III, CEO and ex-Chief CPU Architect at Apple for a decade with another 10 years as an Arm fellow; Manu Gulati, SVP of Silicon Engineering and former lead SoC architect at Google with an 8-year stint at Apple; and John Bruno, SVP of System Engineering and ex-System Architect at Google as well as the founder of Apple’s silicon competitive analysis team. NUVIA has also hired key people known to AnandTech, such as Anthony Scarpino (Senior Director Software, former AMD/ATI), Jon Carvill (VP Marketing, former Intel and Qualcomm), Jon Masters (VP Software, former Red Hat), and Heather Lennon (Digital Marketing, former AMD and Intel). Jon Masters has since returned to Red Hat after 11 months at NUVIA.

We do know some about NUVIA’s first generation of products, known as the Orion SoC using the Phoenix core with ‘an overhaul of the traditional CPU pipeline’. NUVIA has stated that this new design will deliver industry-leading performance with the highest levels of efficiency, with their own numbers targeting +40-50% IPC increases over Zen2 for only a third of the power. On top of this, NUVIA will have to create an ecosystem and distribution platform for its products, which is likely where the Dell involvement will kick in.

With the recent announcement of the acquisition of Arm by NVIDIA, it would be interesting to hear how this might change the relationship between Arm and its partners, particularly architecture licensees, such as NUVIA. There’s no doubt that the future of that relationship is going to be a strong part of how future roadmaps are formed, or in NUVIA’s case, future rounds of funding.

Related Reading

- NUVIA: New Server CPU Startup Going After Intel and AMD

- NUVIA Phoenix Targets +40-50% ST Performance Over Zen 2 for Only 33% the Power

- It’s Official: NVIDIA To Acquire Arm For $40 Billion

- Arm Announces Neoverse V1 & N2 Infrastructure CPUs: +50% IPC, SVE Server Cores

21 Comments

View All Comments

name99 - Thursday, September 24, 2020 - link

The question that matters is: why did GW3 do this?The naive answer is "Apple wouldn't let him create server cores". To me that sounds insane; obviously Apple will soon be using the same tech they'll use for iMac Pro and Mac Pro in data centers.

So the answer must be something else, in other words:

- get very rich or

- create an empire.

If THOSE two are the goals, then what helps further them? One obvious answer is acquisition. Obviously helps with the very rich, and done properly allows empire creation.

So who might engage in such an acquisition? It's easy to suggest possibilities, without being able to say anything certain until both the nVidia/ARM deal and the future course of ARM servers are clear (the latter perhaps by this time next year, once we see what Amazon does with V1, and what the "just you wait for AMD-next and Intel-next" camp have delivered. But some possibilities that seem plausible include

- nVidia (especially if the ARM deal does not go through)

- Microsoft (we can do anything Apple can do, only better)

- AMD (we can see the twilight of x86 as well as anyone, and we won't fumble it this time)

Less plausible (but not insane, IMHO) possibilities

- Cisco (full service data center provider...)

- IBM (POWER had a good run, but what if we couple our memory/IO to ARM's raw compute performance?)

- Intel (look, we screwed with x86, OK, we admit it. But we're the company you trust for your enterprise IT, and boy do we have a good range of new server chips for you. And your autos will also love them.)

Ian Cutress - Thursday, September 24, 2020 - link

"Apple wouldn't let him create server cores" is exactly the reason. I've heard from multiple primary sources. Now that may change in the future. Apple doesn't sell the chips it makes anywhere else - if it made its own server processors, it would only use them themselves, and they'd be rebuilding their entire back-end infrastructure from x86 to Arm. You have to wonder what benefit for Apple that would be.Zeratul56 - Thursday, September 24, 2020 - link

I think it would be interesting if one of these companies released an arm workstation running Windows on ARm. Server back ends have had different architectures off on but if one of these new ARM startups could break the biggest rock in the industry, wintel, It would get people talking. Right now, Microsoft is trying and failing to get off x86 due to the anemic performance of Qualcomm when compared with other modern intel and arm cpu's.name99 - Friday, September 25, 2020 - link

I see Apple at some point launching the equivalent of AWS for Apple developers -- a way to provide remote compute service for non-huge companies that provides Apple-like APIs, security, and hooks into the Apple ecosystem. Something like that is much more desirable if it's running the same ISA as the rest of Apple.More generally, if ARM servers are overall a better value proposition (cost, performance, security) for everyone, the same is true for Apple. So they can buy ARM servers from Ampere, or they can use their own chips. Using their own chips seems cheaper and gives more control.

Ultimately few people are going to say "the reason I'm leaving my company to start a new one is because I want to become Silicon Valley Rich" or "start my own empire". I mean, that's just human nature. You clothe your exit (maybe even your tell yourself) it's somehow for the benefit of humanity.

webdoctors - Friday, September 25, 2020 - link

You don't make crazy money in HW. Especially in licensable CPU cores, look at ARM considering their size they're not making crazy money on CPU licensing. Spending a few years making wattsapp or byteDance or SurveillancePhoneApp2.0 will get you a far higher return in SV than designing HW that requires another company to integrate it into their products.PandaBear - Friday, October 30, 2020 - link

Amazon already bought Anapurna for $400M years ago. They won't buy it.Peskarik - Thursday, September 24, 2020 - link

Good luck to them. Innovation is good.DukeN - Thursday, September 24, 2020 - link

My gf loves their rings!Samus - Friday, September 25, 2020 - link

But do you? Tell us how you really feel!GuyOnABudget - Thursday, September 24, 2020 - link

For Ian: "two the final two acting as investor partners." (second paragraph)Excited to see NUVIA back their bold claims of "+40-50% IPC increases over Zen2 for only a third of the power," which we've seen before.